About me

I am an Assistant Professor of Finance at the Simon Business School, University of Rochester. Previously, I served on the faculty at Drexel University and worked as a senior law clerk at the Supreme Court of Israel.

My research focuses on the economics of regulation: how rules are written and enforced, how incentives and preferences shape regulatory decisions, and how regulation affects firms and markets. I use advanced empirical methods and novel datasets to study these questions.

My work has been published in the Journal of Finance, Review of Financial Studies, Management Science, and Journal of Law and Economics. I am a recipient of the Rising Scholar Award (2022) and the Brattle Group Award (2025).

BTW, I recently read an interesting memo on AI and academic research.

Profiles: Google Scholar · SSRN · CV

Contact: jkalmeno@simon.rochester.eduResearch Interests

- Economics of Regulation

- Law and Economics

- Labor & Finance

- Corporate Governance

Education

- PhD in Finance, 2020

New York University, Stern School of Business - M.Phil. in Finance, 2019

New York University, Stern School of Business - B.A. in Economics & LL.B. (Law), 2012

The Hebrew University of Jerusalem

Regulation Tracker

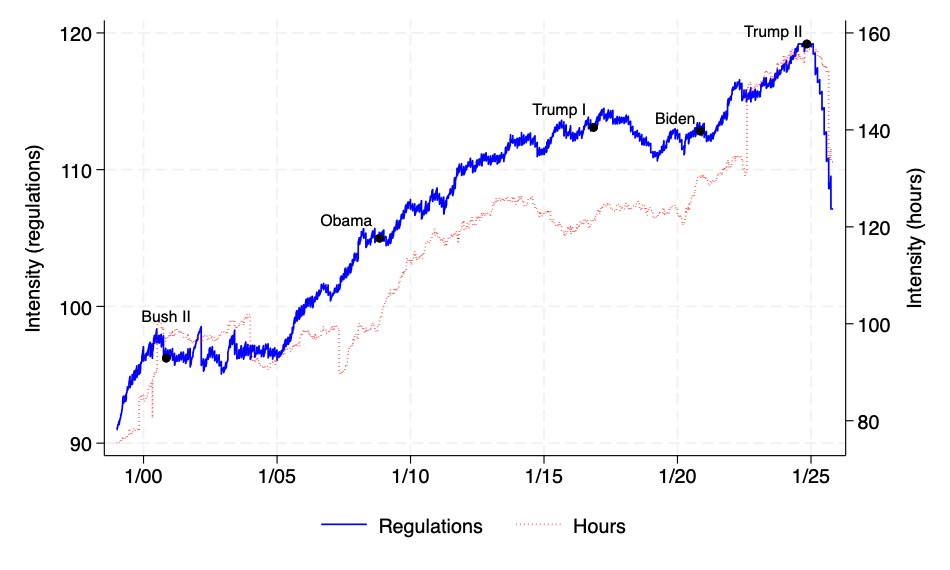

The figure below tracks the burden of federal paperwork requirements over time, updated through February 28, 2026. I have developed the two complementary indexes in Regulatory Intensity and Firm-Specific Exposure (RFS 2023). The blue line captures the cumulative number of regulatory mandates (“How many rules?”), while the red line reflects the total estimated compliance time in hours (“How many hours does it take to comply?”). Labels indicate presidential administrations. Both series are normalized, so the levels should be interpreted in relative rather than absolute terms.

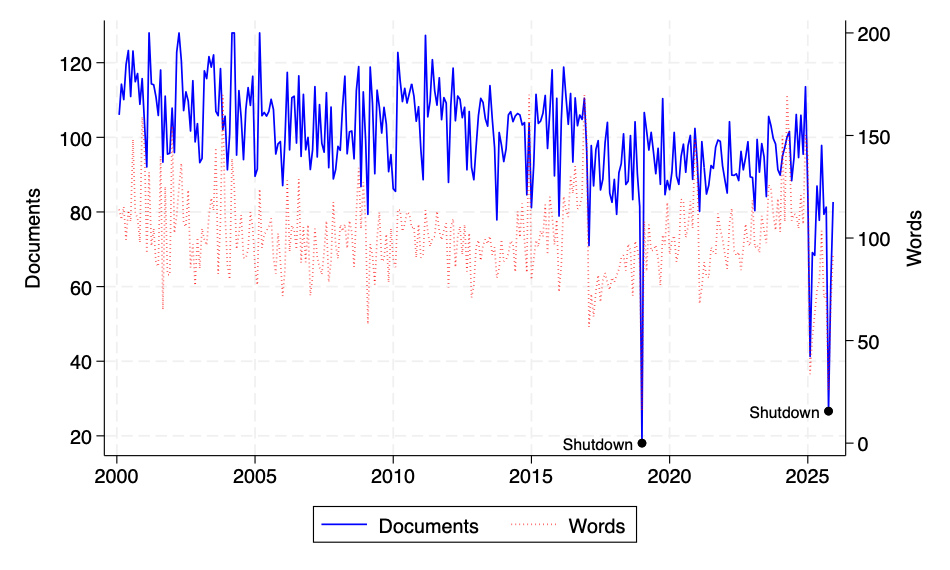

The figure below tracks all regulatory activities by all federal agencies based on Federal Register records, updated through February 28, 2026. The underlying Federal Register data are used extensively in Regulatory Similarity (JLE 2024) and Regulatory Fragmentation (JF 2025). The blue line (left axis) reflects the number of documents, and the red dashed line (right axis) reflects the number of words. The labeled black markers highlight months affected by federal government shutdowns, which coincide with sharp but temporary declines in publication activity. Both series are normalized, so the levels should be interpreted in relative rather than absolute terms.

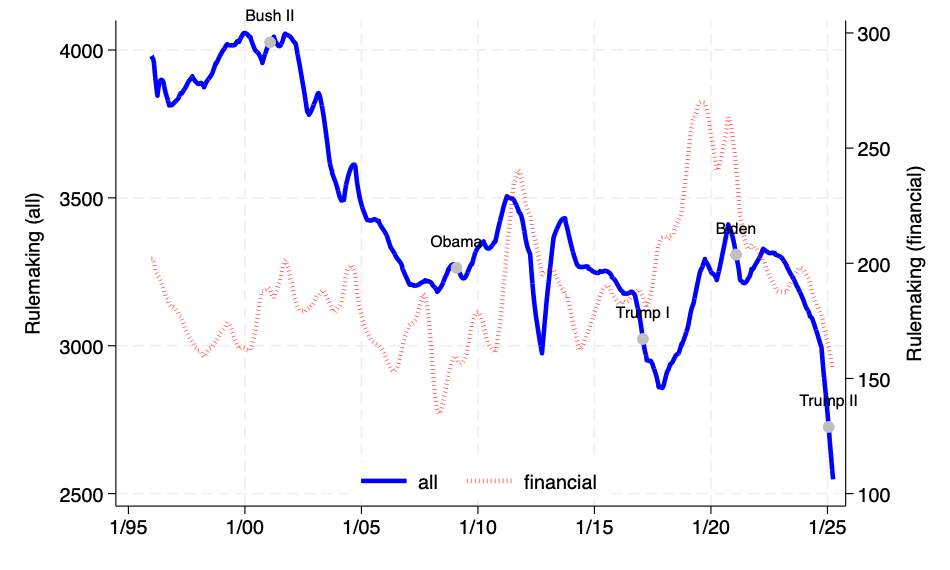

The figure below tracks the volume of regulations under development by federal agencies, updated through March 31, 2025. The indexes are presented in Follow the Pipeline (2023). The solid blue line reflects the total rulemaking activity across all agencies, while the dashed red line isolates financial regulations. Labels mark presidential administrations.

Datasets

- Regulatory Fragmentation : firm-level data on regulatory fragmentation (intuitively: how many agencies supervise the same topic).

- Regulatory Similarity : firm-to-firm data on regulatory similarity (intuitively: how similar is the regulatory requirements of two firms).

- Regulatory Intensity and Firm-Specific Exposure : firm-level data on regulatory intensity (intuitively: how much does the firm pay to comply with federal regulations).

- Follow the Pipeline : firm-level data on regulatory pipeline (intuitively: how many rule proposals will become final rules).

- Incentivizing Financial Regulators : employee-level data on incentives & enforcement at the Securities and Exchange Commission.

- Regulatory Risk Perception and Small Business Lending : employee-level data on incentives & loan guarantees at the Small Business Administration.

Papers

Published and Forthcoming

-

Closing the Revolving Door, with Siddharth Vij & Kairong Xiao. Journal of Finance, forthcoming (2025).

Paper · Slides · Best Paper Award (FMCG) · Gupta Governance Institute · The Visible Hand · ProMarket

-

Regulatory Risk Perception and Small Business Lending, with Siddharth Vij. Management Science, forthcoming (2025).

Paper · Data · Slides · John W. Ryan Award

-

Regulatory Fragmentation, with Michelle Lowry & Kate Volkova. Journal of Finance 80(2), April 2025, Pages 1081-1126.

Paper · Data · Slides · Brattle Group Award · Best Paper Award (FMARC) · Best Paper Award (Korean Securities Association) · FinReg Blog

- Regulatory Similarity, with Jason Chen. Journal of Law and Economics 67(3), August 2024, Pages 691-730.

-

Regulatory Intensity and Firm-Specific Exposure. Review of Financial Studies 36(8), August 2023, Pages 3311-3347.

Paper · Data · Slides · Bloomberg News · Harvard Law School

-

Incentivizing Financial Regulators. Review of Financial Studies 34(10), October 2021, Pages 4745–4784.

Paper · Data · Slides · Rising Scholar Award

Working Papers

- Equal Job, Unequal Pay? Evidence from 4 Million Regulatory Careers, with Michelle Lowry & Billy Xu. ECGI Finance Working Paper 1114.

- The Liberal Tilt of Financial Regulators, with Denis Sosyura & Jason Chen.

- When Diversity Rules, with Abhinav Gupta, Ravi Ranjan, & Kairong Xiao.

- Contagious Deregulation, with Jakub Hajda & Billy Xu.

- Between Boardrooms and the Beltway: The Career Paths of Senior Regulators, with Ran Duchin & Jeffery Wang.

-

Escaping Pay-for-Performance, with Jason Chen & Jakub Hajda. ECGI Finance Working Paper 1055.

Paper · Slides · Best Paper Award (Wellington Finance Summit) · ECGI Blog · ProMarket

- Much Ado About Nothing? Overreaction to Random Regulatory Audits, with Sam Antill.

-

Follow the Pipeline, with Suzanne Chang, Jakub Hajda, & Alejandro Lopez-Lira.

Paper · Data · Slides · Best Paper Award (Sydney Banking Conference)

- Does Regulatory Exposure Create M&A Synergies?, with Eliezer Fich & Tom Griffin.

- The Environmental Consequences of Pay Inequality, with Jason Chen.

Presentations & Discussions

Presentations:

The list below includes scheduled and already delivered presentations of papers by me and by my coauthors, from 1/1/2026 through 12/31/2026.

American Finance Association (AFA); Rome Junior Finance Conference; University of Connecticut Finance Conference; Society for Institutional & Organizational Economics (SIOE); Southwestern Finance Association (SWFA); Midwest Finance Association (MFA) (X2); Bretton Woods Accounting and Finance Ski Conference; Nanyang Technological University; National University of Singapore; University of Technology Sydney; University of Sydney; Federal Reserve Board of Governors

Discussions:

The list below includes several scheduled and already delivered discussions of papers.

- How Do Multiple Regulators Regulate? Evidence from Fairness Opinion Providers' Conflict of Interest Disclosures (Berger, Geoffroy, Imperatore, and Liu; January 2026).

- Hard Facts or Cheap Talk? Strategic Communication and Policy Change in Regulatory Rulemaking (Hackinen, Carenini, Tirole, and Trebbi; November 2025).

Misc

- Inside the Beltway - The Hidden Architecture of Regulation: lecture for Simon's Campaign Alumni Council (February 2026)

- A Quick Guide for the Perplexed PhD Student: teaching notes for PhD candidates (Updated Version: December 2025)

- Introduction to Mergers & Acquisitions: lecture at Simon's Meliora Investment Club (November 2025)

- Understanding the Regulatory Landscape: lecture at Simon's China Advisory Council (August 2025)

- How DOGE is Dodging the Real Issue: interview for Simon's Dean's Blog (March 2025)

- Introduction to Regulatory Economics: lecture at Stanford University (May 2024)

- The Academic Journey: interview for the Simon Business Magazine (November 2023)

- Seven Insights on Regulation: lecture for Simon's Quick Takes Series (April 2023) (slides)